Here, my favorite mentor is Dave Ramsey. He walks you step by step through what you need to know to create a personal financial plan and help you get your money in order. With a clear idea of your goals and a good understanding of your budget, you can now start thinking about the next steps in your personal financial planning process. Preparing a budget or financial plan is essential to give you the best chance of achieving your personal and family goals.

Similar to the priorities created when reviewing your financial goals, personal financial planning requires that you meet many financial goals before you start saving to achieve your lifelong financial goals. You can also list your financial goals in the order you want to reach them, but a long-term goal like saving for retirement requires you to commit to achieving it while working on other goals.

Set short-term goals like stick to a budget, cut expenses, pay or stop using credit cards. Even better, though, short-term goals include getting as much control over your budget as possible, adjusting your spending habits, eliminating credit card debt, setting aside a certain percentage of your income, and/or building up your emergency/rainy day fund. Other long-term financial goals may include debt-free living, mortgage payments; go on a long, unique journey; get your kids through college without debt; build an estate that will give your children a choice in life; or leave a legacy to your favorite non-profit organization.

Examples of medium-term financial goals include saving enough money to make a down payment on a house, paying off a large student loan, starting a business (or starting a second career), paying for a wedding, holding prepaid funds for your kids’ college, getting a dream vacation, or even a year off. Once you’ve built a financial safety net with an emergency fund and adequate insurance, you can start saving to meet longer-term financial planning goals. If you have more than six months of savings in your emergency account (nine months if you are self-employed) and enough money for your short-term financial goals, then start thinking about investing.

Having a solid financial plan will allow you to save money, afford what you really want, and achieve long-term goals like saving money for college and retirement. Either way, personal financial planning, including budgeting, tracking expenses, and savings, is key if you want to get out of debt and reach your financial goals. Below you will learn how to create a savings plan that will help you reach your financial goals at different stages of your life.

What You Need to Know About Personal Finance

If you’re looking to improve your financial situation, here are some tips and tricks that will help you become a better saver. This article originally appeared on Quora. You can learn more about budgeting, saving for retirement, using credit cards wisely, and debt management. Then, get on a track to build your own personal finance manual. It may be easier than you think! After all, you’re not alone!

Budgeting

Personal finance budgeting is an essential step in finance operations. It is a detailed chart that allocates incomes and expenditures to meet specific goals. It also enables you to compare actual financial status with the forecast and identify probable reasons for deviations. To prepare a budget, you must gather all your bills, investment statements, and other information that will help you keep track of your expenditures. In addition to the bills, you should also gather all your investment statements to determine the exact amount you need to invest and spend.

The main goal of budgeting for personal finance is to control expenses and increase income. Setting up a budget can help you identify the categories that require more attention. This way, you can decide what to cut and prioritize. For example, if you earn $46,000 a year, you should set aside about $530 per week for your weekly expenses and $620 for your annual expenses. It’s also a good idea to cancel subscriptions that you don’t use and compare your bills to see if you can get a better deal elsewhere.

Another effective way to set up a budget is by using zero-based budgeting. This type of budgeting focuses on examining each expense line-by-line to make sure that all of your income is equal to all of your expenses. This method is more rigorous than traditional budgeting, but it can help you save a large amount of money every month. But it’s also the most accurate way to allocate income and expenses.

Saving for retirement

Most for-profit employers offer a 401(k) retirement savings plan. To join, you fill out a simple form, deposit money with the company, and the company holds it for you. Some employers automatically increase the amount that you can save. Others allow you to set a fixed dollar amount. The more specific your goals, the easier it will be to achieve them. Make sure you know exactly what your savings goal is and stick to it.

Most people in their 30s are already moving from entry-level jobs to higher-paying positions. However, they may still have student loans, credit card debts, and other debts. While you can begin saving now, keep paying off your debt. The earlier you start saving for your future, the more choices you’ll have when you retire. Also, keep saving in a taxable brokerage account. These accounts are more flexible, and they can provide you with tax breaks while helping you save for retirement.

As you approach retirement, review the percentage you’re contributing to your employer’s retirement account. Consider increasing your contribution rate above your employer’s match. Ideally, you’ll have three times your annual salary in retirement savings. In addition to increasing your employer’s match, you should open an IRA to increase your tax-advantaged retirement savings. As you approach retirement, it is important to continue to increase your savings rate each year.

When planning for retirement, it’s important to remember that Medicare does not cover everything. You might have more money to spend on travel, dining out, gifts, or other needs. You may also want to consider purchasing long-term care insurance. These policies can help you with the cost of nursing home care – unplanned health expenses can wipe out all your savings. A good retirement savings calculator will help you plug different scenarios into it so you’ll know how much you’ll need to save for all your expenses.

Using credit cards wisely

Credit cards can be a great tool for managing personal finances, but they also carry certain risks. If you use your cards wisely, they can help you build a good credit history, earn rewards for everyday purchases, and pay off high-interest debt. You can also apply for interest-free financing with your card. As long as you pay your bills on time and keep your credit utilization rate low, you’ll be able to get the most benefits from your cards.

One of the biggest risks of using a credit card is building up a bad credit history. Overuse of a card can result in a poor credit history and financial stress. It’s best to use your card wisely and only use it for necessities, like gas or a latte. You should also try to pay your utility bill with it after paying your rent, so you can pay off your card before the next due date.

Using credit cards wisely can improve your cash flow, credit history, and credit rating. While it’s tempting to use a credit card for impulse shopping, you shouldn’t make purchases you can’t afford. Instead, try to stick to debit cards when spending money, and charge things purposefully and only if they’re essential. If you’re struggling to manage your finances, a credit card can be a useful tool.

While many people feel that using a credit card wisely will boost their credit scores, fees aren’t easy to avoid. Credit card companies want to know that you’re reliable, which is why they look at your credit score. Making monthly payments on your card will improve your credit score. This will make you more attractive to lenders, and you’ll be able to qualify for the best interest rates. You can also use credit cards wisely by minimizing fees and maximizing the rewards that come with them.

Managing debt

If you want to improve your personal finance, a good debt management plan includes paying off your debts as early as possible. If you have more than one creditor, you should pay off one debt at a time and consolidate all of the accounts into one. In this way, you will be paying off one account at a time and making larger payments every month. This will lower your overall debt burden, and you’ll be able to avoid late fees and high interest rates.

Another option to help you manage your debt is credit counseling. If you’re in over your head with debts, a credit counselor can help you make budget and repayment plan. They can also negotiate with creditors to reduce your interest rates and payments. In some cases, debt management can lead to a reduction in payments, or even a total debt elimination. However, beware of scam credit counselors that offer to help you manage your finances by eliminating your debts.

While debt can be a valuable and useful tool in your finances, it’s best handled with caution. Debt can damage your credit score if not handled correctly. As long as you have liquid assets to pay back your debt, you can manage it successfully. But it’s important to remember that debt is a tool that you shouldn’t treat as a burden. If you don’t understand how to manage your debt, you can’t expect to achieve success.

One of the best options for debt management is to refinance your loans. Debt consolidation allows you to get one low-interest rate loan and one monthly payment. That way, you’ll have more money to pay off your other debts. Another option to consider is debt settlement, which is a negotiation process with creditors. However, the debt settlement process is lengthy and expensive. Many companies charge between 15 and 25 percent of the total debt amount. That means that if you owe $20,000 in consumer debt, you could pay as much as $3,500 or $5,000 in fees.

Investing in personal finance

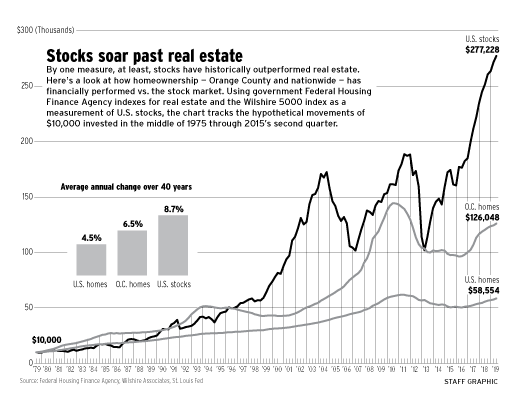

Before investing, it’s important to get your financial house in order. Create an annual budget, limit your debt, and manage your expenses. Have a minimum emergency fund of three months’ expenses and invest any surplus cash. You can even get insurance for your investments. By taking care of these issues now, you can reap the rewards of investing in the future. Investing is an excellent way to build wealth over the long run.

A well-managed financial situation can give you the freedom to travel, spend money on whatever you want, and more. By following a plan and keeping track of your money, you can enjoy the freedom of financial freedom sooner. Personal finance is a good way to make wise investment decisions and pay off debt faster. If you follow this plan, your financial future is just around the corner. With these tips, you can make a positive financial impact and realize your dreams.

Once you have your financial plan in place and set to work, it is important to review it frequently and make the necessary adjustments if your goals or circumstances in your life change. The key is defining your financial plans – this step will help you understand the purpose of the next steps and give you guidance when it comes to money. Good financial management comes down to having a clear plan and sticking to it. Whichever lifestyle you find most appealing will affect your personal financial plan as it helps you achieve your goals.

Join The Personal Wealth Creation (PWC)™ – Launching (50% Discount)

Learn How to Develop Wealth at a Personal Level.

On the Personal Wealth Creation, you will learn:

- Beliefs of The Multi-Millionaires

- How the Wealthy Manage their Money

- How to Increase Your Income

- How to Manage your Money & Reduce Your Expenses by 20-35%

- How to Build a Fortune by just Investing 15% of Your Income

- How to Design Your Millionaire Master Plan

- And Much More…

Helpful Links:

Homepage

About

Contact

Personal Development Partner