What is? Concepts

An exchange-traded fund (ETF) is a security that combines the flexibility of a stock with the diversification of a mutual fund. Like mutual funds, ETFs provide a way for investors to pool money into funds that invest in stocks, bonds, or other assets, earning interest on that pool of investments. Many ETFs can provide diversification and help protect against downside risk by investing in different stocks, bonds, commodities, and currencies in the same fund. You can invest in your assets in the usual way using stock indices and bond ETFs and adjust your allocations as your risk tolerance and objectives change.

ETFs can be traded like stocks, but are more like mutual funds and index funds internally, and can be very different in terms of the underlying assets and the investment objectives of mutual funds and index funds. ETFs are traded the same way stocks are traded on major exchanges such as the New York Stock Exchange and Nasdaq. ETF shares are traded on exchanges throughout the day, while mutual funds can only be bought and sold at the end of the trading day. Like individual stocks, ETF stocks trade at prices that fluctuate based on supply and demand throughout the day.

Like stocks, ETFs can be traded on exchanges and have unique ticker symbols that allow you to track their price activity. Typically, ETFs combine the characteristics of mutual funds (mutual funds can be purchased or redeemed at the end of each trading day at their net value per share) with the intraday functionality of closed-end funds, whose shares trade intraday at market prices. Closed-end funds are not considered ETFs, even though they are funds and traded on exchanges. However, unlike mutual funds, ETF shares are traded on national stock exchanges, and the market price may or may not be equal to the stock’s net asset value (“NAV”), which is the value of the asset. The ETF minus its liabilities divided by the number of shares outstanding.

Each ETF discloses its net asset value (NAV) at the end of the trading day, just like mutual funds, so when market prices also deviate, fund managers can sell or trade to create units to keep the ETF in value with the underlying asset Consistently stay away from NAV. Shares in any ETF are traded at market price (not NAV), may be sold at a discount or premium to NAV, and are not redeemable by the fund alone. As an investor, you are purchasing shares of the entire portfolio, not actual shares of the underlying investments or index constituents; however, you are entitled to dividends distributed or interest earned by the ETF.

Brokers buy these shareholdings for cash or trade in kind for the types of assets the ETFs hold. Financial services firms sell blocks of ETF shares (called “creation units”) to broker-dealers to ensure that ETF share prices remain largely in line with the underlying index or bottom-holding asset prices.

While ETFs are designed to track the value of an underlying asset or index, whether it’s a commodity like gold or a basket of stocks like the S&P 500, they often trade at a different price to that asset. Passive ETFs (also called index funds) track only a stock index, such as the S&P 500. An exchange-traded fund (ETF) is a collection of stocks that typically seek to track the market performance of an index, such as the S&P 500, the Dow Jones Industrial Average, before fees and expenses. Jones or Russell 2000, but they can also be actively managed.

An ETF is a type of publicly traded investment product that must be registered with the SEC under the 1940 law as a public investment company (commonly known as “funds”) or as a mutual fund. Bond ETF: An exchange-traded fund that specifically invests in bonds or other fixed income securities. FX ETFs: Invest in a single currency or a basket of different currencies and are widely used by investors who want to access the foreign exchange market without directly trading futures or the forex market. FX ETFs typically track the most popular international currencies such as the US dollar, Canadian dollar, euro, British pound, and Japanese yen.

Some exchange-traded funds may hold a combination of physical commodity investments and related equity investments—for example, a gold ETF’s portfolio may combine physical gold holdings with stakes in gold mining companies. These funds have a limited public trading history and have not performed like other actively managed ETFs that publish their portfolio holdings on a daily basis. Inverse ETFs: Exchange-traded funds are created using various derivatives to profit from short sales when the value of a group of stocks or a broad-cap index falls. Other index ETFs, such as the Vanguard Total Stock Market Index Fund, use a representative sample to invest 80% to 95% of their holdings in the underlying index securities and the remaining 5% to 20% in other assets such as futures, options, Swaps and securities not included in the underlying index that the fund advisor believes will help the ETF achieve its investment objective.

ETFs are fairly easy to understand and can generate decent returns without much investment or effort. Before we go any further, there are some important concepts to understand before buying your first ETF. Commodity ETFs are similar to ETFs that invest in stocks and trade in the same way as stocks; however, because they do not invest in securities, commodity ETFs are not regulated by investment companies under the U.S. Investment Company Act of 1940, although their public offerings are subject to The SEC reviews and requires review. No action was taken under the Securities Exchange Act of 1934.

Conclusion

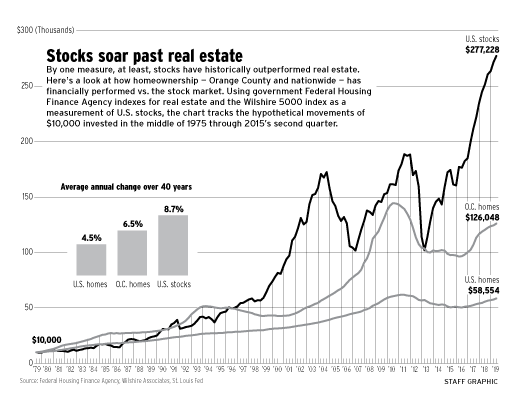

For the last 50 years, the S&P 500 has gone through many ups and downs. However, it has returned an annual compounded rate of return of 12.08% over the period (with dividends reinvested).

So what is the idiot-proof strategy for making money in the markets? Well, simply buy the entire market of stocks (S&P 500 or STI) and stay invested for at least 5-10 years. This way, you will make an annual return of 10-12.08% with little or no risk at all. And as I had revealed in the earlier chapter, by just saving 10% of your income and investing it at the rate of 12.08%, you would become an automatic millionaire at the end of your working career.

So you could be a complete idiot with zero financial intelligence and still end up with a huge net worth when you are ready to retire.

The only two skills you need are ‘patience’ and ‘discipline’. For those of you who are looking for much higher returns within a much shorter period of time, you will learn how to beat the market using more advanced investing strategies in some of our online courses.

Helpful Links:

Homepage

About

Contact

Personal Development Partner